4 min read

Breaking Tradition May Yield the Best Strategic Planning Results

It’s time for us to break up with rigid strategic planning processes that hold us back from spurring growth. Instead, consider testing these methods.

4 min read

by:

Brian Blaha

on

Dec 09, 2025

Brian Blaha

on

Dec 09, 2025

Brian is a seasoned CPA firm leader and strategist with decades of experience driving transformation across professional services. A former Chief Growth Officer at Wipfli, he now advises firms and PE groups on leadership alignment, M&A integration, and sustainable, people-first strategy.

Table of Contents

Every accounting firm wants advisory revenue. The data confirms it: 80% of firms report increasing client demand for financial planning and business strategy services. Partners everywhere see the opportunity: higher margins, stickier client relationships, and differentiation from commoditized compliance work.

Yet, for many, launching an advisory practice follows a predictable pattern. Firms hire advisory talent with great credentials. They expect results to follow quickly, and when revenue doesn't materialize in the first 18 months, frustration builds. Eventually, leadership abandons the effort entirely, concluding that advisory "doesn't work for firms like ours."

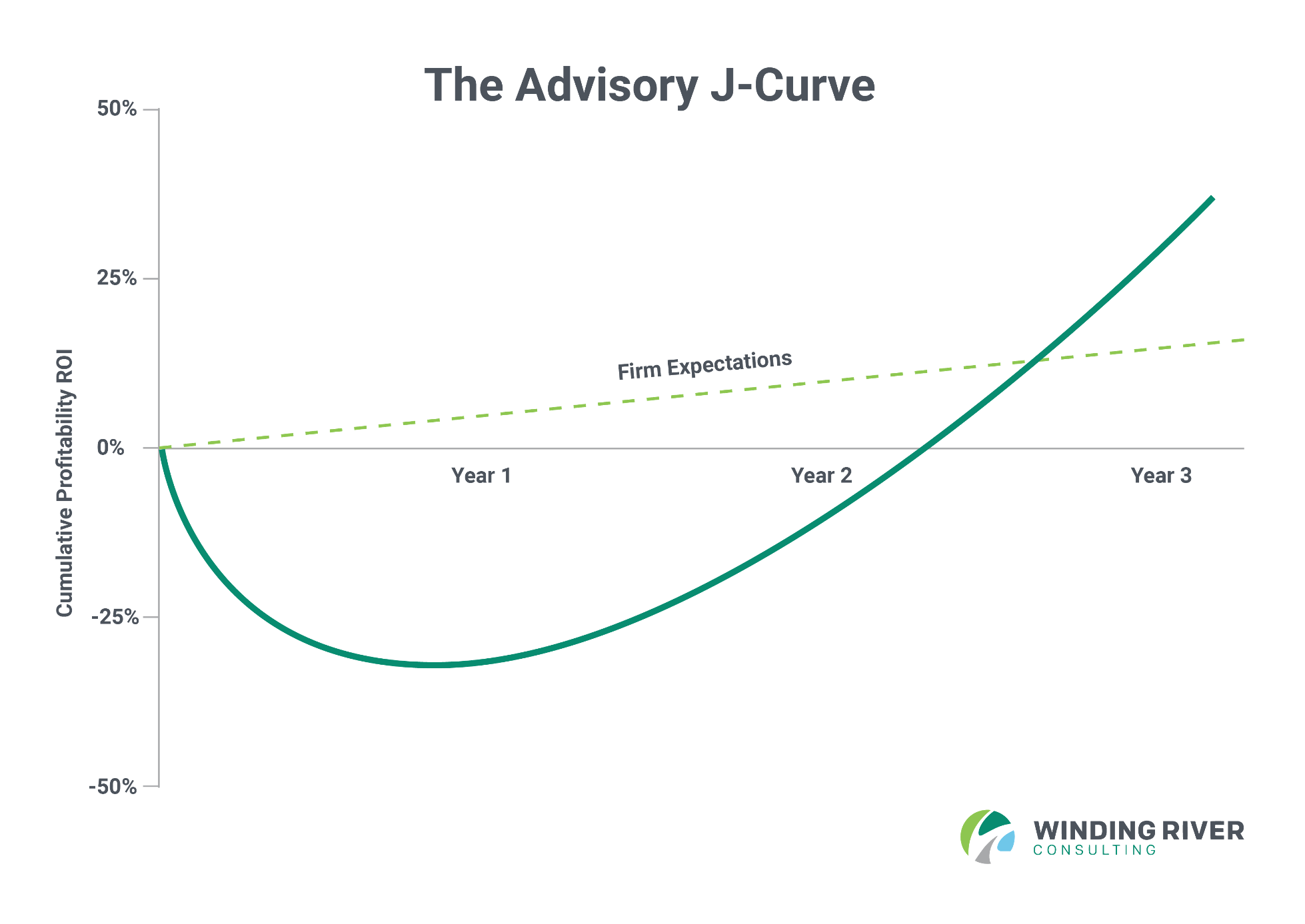

The problem isn't market demand. It's that firms treat practice development like hiring tax capacity: add a professional, expect production. But advisory is a business build, not a workflow fill. That means upfront investment and delayed returns: the classic J-curve.

This concept, borrowed from private equity, explains why most advisory initiatives fail and what separates firms that break through from those that don't.

When you hire a tax senior, they're productive within weeks. They leverage existing workflows, work in established service lines, and benefit from clear expectations. Advisory development operates fundamentally differently. You're building a business from scratch.

Year one is foundation: developing frameworks and the service offering, establishing market presence, creating thought leadership, and building relationships. Revenue, if any, comes from low-hanging fruit that doesn't represent a sustainable pipeline. During this period, you’re not just recruiting one consultant to run the practice; you’re building an entire team that’s capable of scaling over the coming years.

Year two is market development: early client work begins, but the focus remains on building mechanisms for repeatable growth: pipeline development, service delivery models, marketing infrastructure, and more.

Year three is inflection: If investment has been sustained, the practice typically reaches profitability and demonstrates capacity for sustained growth. Infrastructure is in place. The market understands your positioning. Growth accelerates.

This pattern—the characteristic dip before the sharp upward trajectory—is the J-curve. The steepness of your eventual growth depends entirely on the magnitude of investment during the dip. Firms that make aggressive, coordinated investments can achieve dramatically steeper trajectories than those taking incremental approaches. But this requires accepting substantial losses during the build phase.

Most partnership structures resist this model. Partners accustomed to distributing all earnings struggle to redirect compensation toward investments with multi-year payoffs. The pressure to maintain current distributions overwhelms the logic of building future enterprise value. This tension explains why so many initiatives fail: firms don't invest enough, for long enough, to reach the inflection point.

The solution requires formal governance: a structure that protects advisory investment from partnership pressure and holds the practice accountable to realistic benchmarks.

Without formal frameworks, firms make ad hoc decisions about advisory. They hire one person without supporting infrastructure. They cut marketing spend when partnership pressure builds. They evaluate progress using compliance-work metrics that don't apply to practice development. The result: insufficient investment to reach the inflection point, followed by abandonment.

The firms that successfully navigate the J-curve apply venture capital discipline to internal practice development.

An investment committee, typically formed of the managing partner, chief operating officer, and business unit leaders, meets quarterly to govern advisory investment decisions. Their responsibilities typically include:

This committee operates from a clear investment thesis: What specific client problems will we solve? What makes our approach differentiated? What's our realistic path to market? What's our expected investment horizon to profitability? This thesis isn't generic aspiration. It's specific positioning that guides all decisions about talent, service development, and resource allocation.

Perhaps most critically, successful firms replace traditional revenue accountability with leading indicators appropriate to each development phase:

Traditional revenue accountability during the build phase creates perverse incentives. Advisory leaders feel pressure to close any deal rather than the right deals, sacrificing positioning and margins for short-term numbers. A better approach is to focus on activities that predict eventual success. Is the practice leader executing sustained market outreach? Generating qualified pipeline? Delivering exceptional client experiences? Building replicable service delivery models?

Revenue remains important, but it's a lagging indicator during the build phase. The investment committee should ask quarterly: Are we making sufficient progress on leading indicators to justify continued investment? This framework allows for learning and course correction without abandoning the initiative at the first sign of difficulty.

Being disciplined with your capital investments doesn't mean you have to commit to infinite patience. The key is establishing evaluation criteria upfront, before frustration clouds judgment.

Stay the course if leading indicators are moving in the right direction, even if top-line results haven’t caught up yet. Consistent market validation, strong client feedback from early engagements, and solid execution by the advisory leader all signal momentum. The model is working; it just hasn’t reached its inflection point.

Pivot if the market isn’t responding despite consistent effort. Lack of traction, misalignment between your capabilities and client needs, an inability to differentiate in ways clients value, or ongoing execution gaps from the advisory leader all point to a deeper structural issue, not just a slow start.

The distinction matters enormously. Execution problems may require leadership changes or strategic adjustments. The natural economics of practice development require patience. Firms that conflate the two abandon initiatives that would have succeeded with proper support.

Evaluate progress annually through a structured committee review, rather than reacting to every quarter’s results. Advisory practices need time to mature, and meaningful traction typically takes at least three years of consistent investment and focus.

Advisory services remain one of the most powerful growth opportunities in public accounting firms, offering higher margins, stronger client relationships, and meaningful differentiation in a crowded compliance market. Firms that build these capabilities effectively position themselves for long-term advantage.

But advisory only succeeds when firms invest with discipline. The J-curve is real: new practices typically lose money before they make it. Achieving sustainable success requires strong governance, clear performance expectations grounded in development economics, and a willingness to absorb early losses in pursuit of long-term growth.

The alternative—the hire-wait-abandon pattern that many firms follow—wastes resources, burns through talented professionals, and reinforces the false belief that advisory doesn't fit your firm. In reality, advisory works for firms that invest properly.

At Winding River Consulting, we work with leadership teams to establish governance structures, set realistic phase-based benchmarks, secure partnership alignment on investment expectations, and navigate the build phase with discipline. Whether you're launching new advisory practices or revitalizing stalled initiatives, we provide the strategic guidance to push through the J-curve to sustainable growth.

Contact us today to discuss how we can support your firm's advisory development strategy.

4 min read

It’s time for us to break up with rigid strategic planning processes that hold us back from spurring growth. Instead, consider testing these methods.

.png)

3 min read

In today’s rapidly evolving business landscape, advisory services have become a crucial component to sustainable growth for certified public...

4 min read

When accountability overshadows inspiration, talent walks out the door. Leaders in every industry, not just professional services, are falling into...